Emergence of 5G Technology

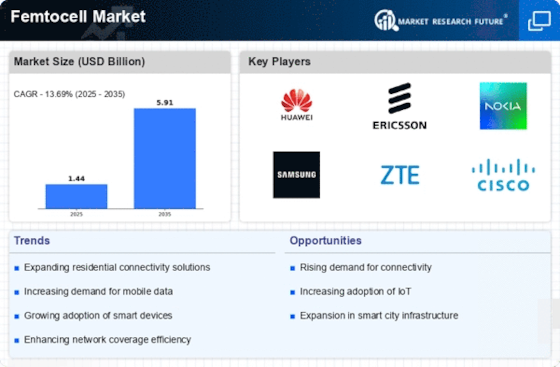

The Femtocell Market is on the brink of transformation with the emergence of 5G technology. As telecommunications companies roll out 5G networks, the demand for femtocells is expected to rise significantly. Femtocells can play a crucial role in supporting the dense network requirements of 5G, particularly in urban environments where high data rates and low latency are essential. The integration of femtocells into 5G infrastructure can enhance coverage and capacity, addressing the challenges posed by increased user density. Market forecasts suggest that the adoption of 5G will drive substantial growth in the Femtocell Market, as operators seek to leverage this technology to meet the demands of next-generation mobile services.

Rising Mobile Data Consumption

The Femtocell Market is experiencing a notable surge in mobile data consumption, driven by the proliferation of smartphones and data-intensive applications. As users increasingly rely on mobile devices for streaming, gaming, and social media, the demand for enhanced connectivity becomes paramount. Reports indicate that mobile data traffic is projected to grow exponentially, potentially reaching several zettabytes annually. This trend compels service providers to invest in femtocell technology to alleviate network congestion and improve user experience. Femtocells serve as a solution to enhance indoor coverage, thereby addressing the challenges posed by high data demand. Consequently, the Femtocell Market is likely to witness substantial growth as operators seek to meet the evolving needs of consumers.

Shift Towards Smart Homes and IoT

The Femtocell Market is poised for growth due to the increasing adoption of smart home technologies and the Internet of Things (IoT). As households integrate smart devices, the need for reliable and robust connectivity becomes critical. Femtocells can provide the necessary infrastructure to support multiple connected devices within a home, ensuring seamless communication and data transfer. The rise of IoT applications, such as smart security systems and home automation, further emphasizes the importance of stable connectivity. Market data suggests that the number of connected devices per household is expected to rise significantly, which could drive the demand for femtocell solutions. This trend indicates a promising future for the Femtocell Market as it aligns with the growing smart home ecosystem.

Increased Focus on Network Optimization

The Femtocell Market is benefiting from an increased focus on network optimization among telecommunications providers. As operators strive to enhance service quality and reduce operational costs, femtocells emerge as a viable solution. By deploying femtocells, operators can offload traffic from macro networks, thereby optimizing bandwidth usage and improving overall network performance. This strategic approach not only enhances user experience but also allows for more efficient resource allocation. Market analysis reveals that operators are increasingly recognizing the value of femtocells in their network strategies, leading to a potential rise in deployments. Consequently, the Femtocell Market is likely to expand as more providers seek to leverage this technology for improved network efficiency.

Growing Demand for Enhanced Indoor Coverage

The Femtocell Market is witnessing a growing demand for enhanced indoor coverage, particularly in urban areas where traditional cellular signals may struggle to penetrate. As consumers increasingly rely on mobile devices for communication and data access, the need for reliable indoor connectivity becomes essential. Femtocells offer a practical solution by providing localized coverage, thereby improving voice quality and data speeds within buildings. Market data indicates that a significant percentage of mobile users experience connectivity issues indoors, which drives the demand for femtocell solutions. This trend suggests that the Femtocell Market is likely to see increased investments as operators aim to address indoor coverage challenges and enhance customer satisfaction.